Earnings: American Express, eBay, Texas Instruments, Las Vegas Sands, SanDisk, Norsk Hydro, Northern Trust, SallieMae, Morningstar,Raymond James

Thursday

Earnings: 3M, Caterpillar, McDonald’s, Amazon.com, Alphabet (Google), Microsoft, Daimler, Dow Chemical, Danaher, AT&T,Raytheon, Eli Lilly, Dr Pepper Snapple, Freeport-McMoran, Nasdaq OMX, PulteGroup, Sirius XM Radio, Under Armour, Southwest Air,Juniper Networks, Pandora, Union Pacific, Alaska Air, Dunkin Brands,Capital One, Stryker

8:30 a.m.: Initial claims

9 a.m.: FHFA home prices

10 a.m.: Existing home sales

Friday

9:45 a.m.: Manufacturing PMI

Earnings: Procter and Gamble, American Airlines, Autoliv, Cabot Oil and Gas, State Street, LM Ericsson, Tenneco, Lear, Citizens Financial,VF Corp.

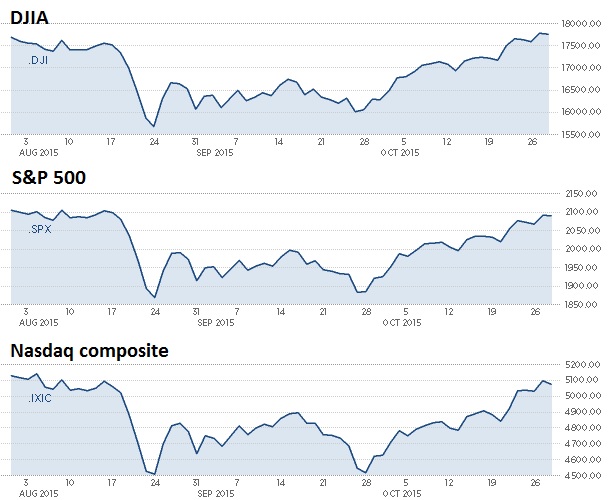

The Nasdaq and the S&P 500 traded in a range before closing near their session lows of 4,836.46 and 2,017.22.

S&P 500 intraday

The Dow Jones industrial average was also in a range, and nearly rose 100 points as Boeing pushed the blue chips index higher after reporting better-than-expected earnings.

Dow Jones industrial average intraday

“The story in the Dow is United Technologies and Boeing versus UnitedHealth Group and Goldman Sachs,” said Art Hogan, chief market strategist at Wunderlich Securities.

United Technologies closed up 2.46 percent, while Boeing ended 1.66 percent higher. Goldman closed down 3.13 percent and UnitedHealthfell 1.92 percent.

Read MoreLatest IBM miss another $600M hit to Warren Buffett

Other companies that posted quarterly results Wednesday includedCoca-Cola and General Motors. GM beat expectations on both earnings and revenue, but Coca-Cola sales fell short of estimates.

“Overall, we seem to be running at the same pace we’ve been running at the last few quarters,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

Shares of GM rose closed up 5.79 percent after rising over 6.5 percent, while Coca-Cola’s stock traded slightly lower.

“That doesn’t take away that only 44 percent of companies have beaten on revenues,” said Nick Raich, CEO of The Earnings Scout.

Read MoreTop managers give under-the-radar earnings picks

Firms scheduled to report after the bell include American Express,eBay and Raymond James.

“We’ve had some pretty rocky earnings, and volatility has been pretty much contained,” said Peter Cardillo, chief market economist at Rockwell Global Capital.

“With all these individual stock stories, the indexes are hanging in pretty nicely,” Hogan said.

On Tuesday, stocks closed narrowly lower as IBM posted disappointing earnings.

Stock took a hit Wednesday as health care turned negative year-to-date.

“Valeant is the killer,,” said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

Valeant Pharmaceuticals plunged as much as 28 percent after the release of a short-seller note on the company.

“Now they’re comparing it to Enron,” Silverblatt said.

Read MoreDon’t look now, but bonds are back (junk, too)

Valeant stock intraday

Investors also digested EIA oil inventories data, which showed inventories rise by 8 million barrels, as U.S. crude prices have fallen over 4.5 percent this week.

U.S. oil futures closed down 2.4 percent at $45.20 a barrel, posting their third straight day of losses.

“We think about low oil as being good for the economy, but I think it’s gotten too low and it’s become a drag in the economy,” Frederick said.

Read MoreTokyo jumps, but Shanghai posts biggest fall in 5 weeks

Wall Street also digested Japanese exports data, which came in far weaker than expected. Japan’s annual export growth slowed for the third straight month in September, raising questions as to whether or not the Bank of Japan will go further into its qualitative and quantitative easing program.

The data prodded up the Nikkei 225, which closed up nearly 2 percent, while China’s Shanghai Composite tumbled 3.47 percent.

“Big picture, easy money is here to stay,” said Adam Sarhan, CEO of Sarhan Capital.

U.S. Treasurys gained ground, as the 10-year yield fell to 2.02 percent and the two-year yielded 0.61 percent.

In Europe, stocks ended mixed, with the pan-European STOXX 600 closing flat and the German DAX ending higher in anticipation of Thursday’s European Central Bank meeting.

In corporate news, Ferrari closed up 5.77 percent at $55 a share on itsfirst day of trading.

SanDisk will be bought by Western Digital for $86.50 a share in cash and stock, or $19 billion.

Morgan Stanley downgraded Twitter‘s stock to “underweight” from “equal-weight,” citing limited user growth and a lack of advertiser demand growth.

Toyota will recall 6.5 million vehicles to fix a power window defect, and another 2 million will be recalled for a potential fire hazard.

The Dow Jones industrial average closed down 48.50 points, or 0.28 percent, to 17,168.60, led lower by Glodman Sachs and with United Technologies leading advancers.

The S&P 500 ended 11.83 points lower, or 0.58 percent at 2,018.94, with energy leading nine sectors lower and industrials the only advancer.

The Nasdaq closed 40.85 points lower, or 0.84 percent, to 4,840.12.

Gold futures settled down $10.40 at $1,167.10 an ounce.

The dollar traded slightly higher against a basket of major currencies.

Decliners led advancers 3 to 1 at the New York Stock Exchange, with an exchange volume of 852 million and a composite volume of 3.591 billion at the close.