Week In Review- Oversold Bounce Continues…For Now

–

–

Do You Qualify?

Find Out If You Qualify To Open An Account?

–

Oversold Bounce Continues…For Now

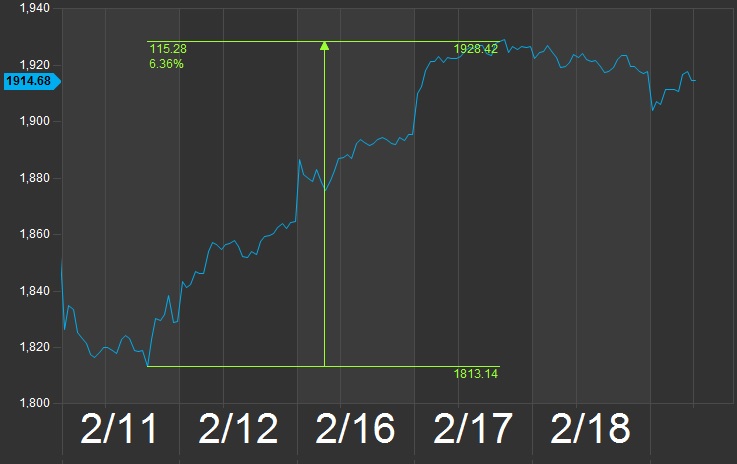

It was another volatile week on Wall Street. After all was said and done, the major indices ended higher as we head into the end of the month. Since the Feb 11 low, we have written that “conditions are ripe for stocks to rally a bit as they work off their deeply oversold levels.” This still appears to be a bull trap – (a.k.a bear market rally). Let’s analyze the facts, over the past three weeks, the benchmark S&P 500 has soared nearly 8% which is not an insignificant sum. In normal times (before massive interference from global central banks), a 10% move for the entire year was considered healthy. So 8.4% in 3 weeks, clearly is a HUGE MOVE and that type of wild action, does not happen in bull markets. Large wide and loose swings typically do not occur in bull markets. Instead, they occur during bear markets. Prior to the 8.4% rally, we saw the S&P 500 fall 7% in 2 weeks. In the short term, the market is flirting with major resistance and the intermediate and long term outlook still remain bleak. To be clear in our thinking, we are still operating with the notion that we are in the early stages of a new bear market for stocks so we have to be very selective moving forward. Second, it is important to note that, in bear markets, surprises happen to the downside. Third, we have to keep in mind that global central banks love interfering with markets and have distorted the playing field for years. Any strong intervention may change the playing field and lead to a stronger bounce. We feel it is just a matter of time until the major indices fall 20% from their 2015 highs which officially defines a bear market. Several important areas of the market are already in a bear market (defined by a decline of 20% or more from a recent high) which means it is just a matter of time until the major indices play catch up to the downside. These are some of the important areas that are already in bear market territory: Commodities, The Small Cap Russell 2000 ($IWM), Transports ($IYT), Biotechs ($IBB), Retail ($XRT), Junk Bonds ($JNK), Materials ($XLB), just to name a few.

Monday-Wednesday’s Action: Stocks Swing In Wide Range

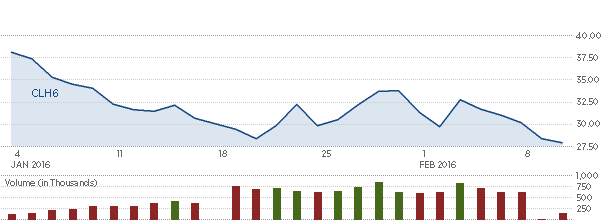

Stocks fell on Tuesday as investors digested a slew of economic and earnings data. Oil prices fell hard on Tuesday after Saudi Arabia said they do not plan on cutting production anytime soon. Economic data was mixed. The S&P Case-Shiller index rose 0.8% in December which matched estimates. Consumer confidence slowed to 92.2, missing estimates for 97.2. Existing home sales rose by 0.4% in January to 5.47 million annualized rate, beating estimates for 5.32M. The Richmond Fed Manufacturing Index came in at -4, missing estimates for 2. The State Street Investor confidence index came in at 106.5, lower than the revised reading of 108.7. Technically, the major indices pulled back after encountering stubborn resistance near their declining 50 day moving average lines on Monday.

Stocks opened lower but closed higher on Wednesday after the latest round of lackluster earnings and economic data were released. Oil prices also positively reversed after the latest EIA report was released. Economic data was less than thrilling. First, February’s Flash PMI Services Index Fell to 49.8, miss estimates for 53. Then New Home sales plunged -9.2% last month to an annualized rate of 494,000, missing the Street’s estimate for 520,000. This clearly shows that the economy is slowing, not strengthening and that is a problem for both Main Street and Wall Street. Earnings data was also less than stellar. Avis -Budget Group (CAR) plunged over 23% after the company lowered guidance for 2016. The company lowered adjusted EPS to $2.70-$3.30, which was lower than the Street’s estimate for $3.43. Target TGT ($TGT) also missed estimates but the stock was not hurt because the company raised guidance. Shares of First Solar ($FSLR) were up slightly after the solar panel manufacturer posted mixed results. Revenue beat analysts’ estimates, but earnings slid to $1.60 from $1.90 the year before.

Thursday-Friday’s Action: Stocks End Week On A Strong Note

Stocks rallied on Thursday as the market added to Wednesday’s very strong positive reversal. Overnight, the Shanghai composite plunged -6.4% and hit a three-week low. Rumors spread that China’s central bank injected another $52 billion into the money market to help stabilize markets. The ChiNext index which tracks small-cap Chinese stocks tanked -7.7% which clearly is not good for the global risk-on trade. We finally had a strong economic report. Durable goods jumped 4.9%, easily beating estimates for 2%. Excluding transportation equipment, durable goods orders increased by +1.8%. Core capital goods orders also jumped +3.9%. Jobless claims rose 272k, which were close to the Street’s estimate for 270k. The Federal Housing Finance Agency (FHFA) said home prices rose 0.4% in December, missing estimates for 0.5%. The report pulls home prices for single family homes using data from Fannie Mae and Freddie Mac. The Kansas City Fed Manufacturing Index fell to negative -12, lower than the last reading of -9. Before Friday’s open, the government said GDP rose by 1%, beating estimates for 0.4%.

Market Outlook: Bear Market Rally

The market is deeply oversold so keep in mind the strongest rallies in history occur during bear markets (a.k.a bull traps). As always, keep your losses small and never argue with the tape. If you want help with the market, contact Adam or – Join FindLeadingStocks.com.