Sarhan CNBC: Stocks mixed despite oil slide; Nasdaq holds higher

The major averages held mixed in midday trade, but well off session lows with the Nasdaq composite trading mostly higher.

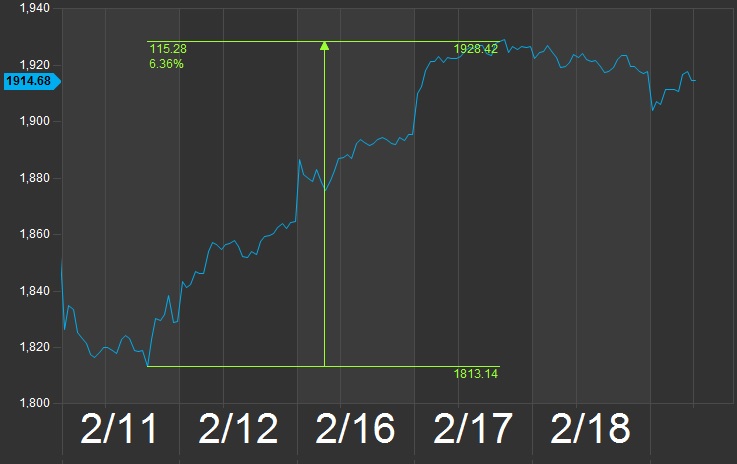

“I think people feel the market’s stabilizing to a certain extent,” Peter Coleman, head trader at Convergex, noting the S&P 500 rallied more than 6 percent from its low last week to its recent high this week. After three solid days of gains, Thursday’s sell-off was “very mild.”

“I’m getting more constructive,” he said.

S&P 500 6-day performance (intraday)

Source: FactSet

The S&P 500 held mostly lower in midday trade, hovering just above 1,910 as energy declined more than 1.5 percent as the greatest laggard. Information technology and financials led advancers.

“I think it’s technical. The market ran into resistance at 1,950 (on the S&P 500),” said Marc Chaikin, CEO of Chaikin Analytics.

“In a market that’s highly volatile and seemingly irrational, the only thing you have to go on are your technicals.,” he said, attributing much of the recent gains to short covering.

The Nasdaq composite turned positive in mid-morning trade, helped by gains in Applied Materials, Facebook and shares of Alphabet, Google’s parent company.

Read MoreThis is the S&P 500 level everyone’s watching

Chevron and Boeing were the greatest contributors to declines on the Dow Jones industrial average, which held about 40 points lower after briefly falling more than 100 points.

“So far the market’s bouncing almost perfectly to work off the oversold conditions we saw last week. There’s still a whole lot of overhead resistance,” said Adam Sarhan, CEO of Sarhan Capital.

“You’ve had a little bit of an emotional relief that will tend to shore up the market in the short-term,” said Bruce McCain, chief investment strategist at Key Private Bank. “You just need a continued flow of … news that beats expectations, less bad than expected.”

Read MoreWeek could end well for stocks if oil holds $30

In economic news, the consumer price index showed a 0.3 percent rise ex-food and energy in January. The headline figure was unchanged from the previous month. Year-over-year, the core CPI advanced 2.2 percent, the largest rise since June 2012, Reuters said.

“The CPI number doesn’t surprise me but it does surprise me the market isn’t taking a closer look at it,” said David Kelly, chief global strategist at JP Morgan Funds.

“I think it’s an important report because it should remind people that underlying inflation pressures are moving up,” he said.

Treasury yields edged higher, with the 2-year yield at 0.74 percent and the 10-year yield at 1.76 percent, as of 9:34 a.m. ET.

The U.S. dollar held mildly higher against major currencies, with the euro at $1.109 and the yen at 113.04 yen against the greenback.

Earlier, U.S. futures indicated a slightly higher open, before erasing gains.

Cleveland Fed President Loretta Mester said Friday that policy will likely need to remain accommodative “for some time” given slow growth abroad, the strong dollar, more restrictive financial conditions and the hard-hit energy sector, Reuters reported. Mester also said Inflation will remain “lower for longer” than previously thought, although the U.S. economy will “work through” market volatility and soft economic data.

Read More: UK’s Cameron says ‘still no deal’ with EU

In earnings news, Deere reported earnings that beat by 10 cents but revenue missed as the strong dollar weighed. The heavy equipment maker said its financial condition is strong, but it expects another “challenging” year ahead.

Nordstrom missed on both the top and bottom line, and gave a below-expectations full-year earnings and sales outlook. The retailer has been negatively impacted by heavy discounting and unseasonably warm weather.

Read More: Early movers: DE, VFC, BBY, SBUX, BHI, JWN, & more

In morning trade, the Dow Jones Industrial Average traded down 116 points, or 0.7 percent, to 16,298, with Caterpillar leading decliners andUnitedHealth and American Express the only gainers.

The S&P 500 fell 14 points, or 0.75 percent, to 1,903, with energy leading all 10 sectors lower.

The Nasdaq composite traded down 29 points, or 0.7 percent, to 4,455.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 22.3.

About four stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 147 million and a composite volume of 304 million in morning trade.

LINK: http://www.cnbc.com/2016/02/19/us-markets.html