Similar Posts

Adam in @CNBC: Stocks Close Flat As Dow Fails To Reach 20,000 Ahead of Christmas

Friday 12.23.16 U.S. equities closed mostly flat on Friday ahead of the Christmas holiday, as the Dow Jones industrial average failed again to reach the psychologically important level of 20,000. The Dow closed about 15 points higher, with UnitedHealth contributing the most gains. “This is the last full trading week of the year. The Dow…

July's Monthly Stock Market Commentary

As we know, the major averages topped out in October 2007 and then proceeded to precipitously plunge until they put in a near-term bottom in early March 2009. Since then, the market snapped back and enjoyed hefty gains which helped send the major averages to one of their strongest 15-month rallies in history. The small cap Russell 2000 Index was the standout winner, surging a whopping +117%. The tech-heavy Nasdaq Composite is a close second, having vaulted +100% before reaching its interim high of 2,535 on April 26, 2010. The benchmark S&P 500 Index raced +83% higher before hitting its near term high of 1,219 on April 26, 2010, and the Dow Jones Industrial Average soared +74% before printing its near-term high of 11,258 on April 26, 2010. This data indicates that Monday, April 26, 2010 appeared to be a very important day for the market because that is the day that most of the popular averages printed their near-term highs and negatively reversed by closing lower from new recovery highs. In addition, after such hefty moves, a 10-18% pullback, if the indices can prove resilient enough to hold their ground near current levels, would be quite normal before the bulls return and send this market higher. However, if the 2010 lows are further breached, then odds will favor that even lower prices will follow. In addition, the downward sloping 50 DMA line undercut the longer-term 200 DMA line for many of the indices which is known as a death cross and is not a healthy sign. Trade accordingly. Never argue with the tape, and always keep your losses small.

Negative Reversal From Resistance; Stocks Give Back Earlier Gains

Heretofore, the action since this rally was confirmed on the September 1, 2010 follow-through day (FTD) has been strong but the market action has been wide-and-loose which is not a healthy sign. The S&P 500 sliced below its two month upward trendline (shown above) which is not ideal. The next level of support for the major averages is their September highs, then their respective 200-day moving average (DMA) lines while the next level of resistance is their respective April highs. We have enjoyed large gains since the September 1st FTD and over the past two weeks, the tape remains somewhat sloppy. Trade accordingly.

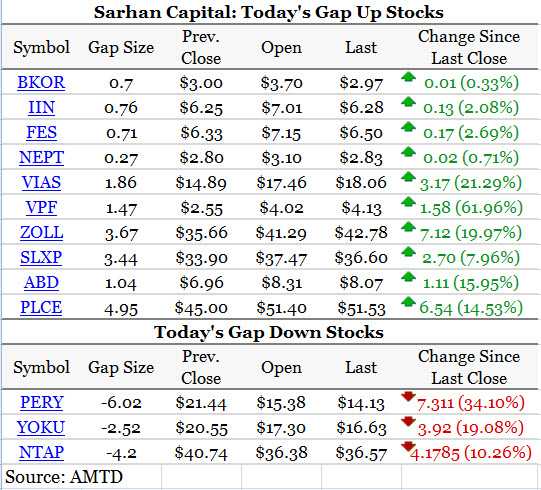

Stocks Moving In Heavy Volume – Thursday 11.17.11

Heavy Volume Movers – Thursday 11.17.11

A Brief History of The Global Economy

LIKE THIS? JOIN OUR FREE NEWSLETTER Has copper lost its importance? The basic premise is that for the past few years, copper and other industrial metals, no longer play a critical role for global economic growth. Don’t take my word for it; the proof is in the charts. Since 2011, copper prices have been…

CIT Names John Thain CEO

Former Merrill Lynch CEO John Thain has been given the top job at CIT. Andrew Ross Sorkin, of the NY Times, and the CNBC news team discuss.