CNBC: Stocks close mostly lower; transports outperform

The S&P 500 ended about 1 point lower after trying to hold in positive territory as the close approached. The Dow Jones industrial average also failed an attempt to hold in positive territory, with Apple contributing the most to gains and Goldman Sachs the greatest weight.

“I think it’s just a market that’s consolidating but reflecting on the fact the Fed indicated yesterday in their statement they see the economy doing good,” said Peter Cardillo, chief market economist at Rockwell Global Capital.

Read MoreWhy the market is misreading the Fed statement

“Transports have begun to stabilize. It’s not really that fear factor of the Fed acting in December,” he said, noting some profit taking.

The Dow transports closed up about 0.8 percent, with Ryder Systemleading nearly all constituents higher.

Health care closed about 0.4 percent higher. The sector briefly rallied more than 1 percent to lead S&P 500 advancers, helped by gains of more than 5.5 percent in Allergan. The firm confirmed that it has been approached by Pfizer and is in talks regarding a potential deal. Shares of both companies were briefly halted. Pfizer closed down nearly 2 percent.

The rate-sensitive utilities sector was the greatest decliner in the S&P, while financials was the second-greatest laggard after leading Wednesday’s post-Fed statement rally.

“Basically we’re hanging on to the 200 points from yesterday,” said Michael Farr, president and CEO of Farr, Miller & Washington.

“I don’t think the market expects the Fed to move at all,” he said, noting the statement was “pure wordsmithing and not material in terms of action.”

The Federal Reserve issued a post-meeting statement Wednesday that was more hawkish than many expected. In the statement, the central bank downplayed September’s concerns about impact from global growth and specifically noted it will be looking for progress in employment and labor when considering whether to raise rates at its December meeting.

The specific mention of the Fed’s next meeting immediately triggered a significant move up in market expectations for a rate hike this year.

Bond yields held higher after rising Wednesday. The 10-year yield was 2.17 percent and the 2-year yield 0.71 percent.

The U.S. dollar traded half a percent lower against major world currencies, with the euro at $1.09 and the yen at 121.08 yen against the dollar.

Many market analysts do not see enough economic support for the Fed to raise rates later this year.

“All data in the last three months shows some slowing,” said James Meyer, chief investment officer at Tower Bridge Advisors. “All they did yesterday was set the table, gave themselves the option (to hike in December).”

Read MoreFed tells markets to wake up, a rate hike could be coming

“As long as we have this disagreement in the market I think it’s going to be very difficult for stocks to reach new highs,” said Chuck Self, chief investment officer of iSectors. “We’re going to be in this trading range for the next few months.”

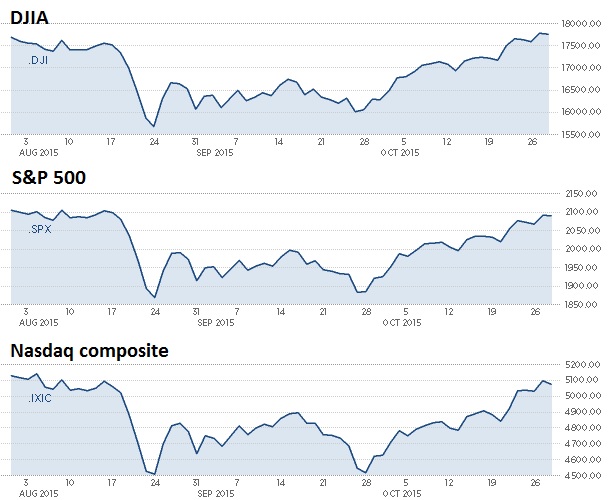

The three major averages are up nearly 9 percent or more for October so far, on track for their best month since October 2011.

“The dynamic has shifted from August and September,” said Adam Sarhan, CEO of Sarhan Capital. “You’re seeing weakness being bought instead of weakness being sold and that’s a big shift.”

Major averages 3-month performance

In economic news, third-quarter GDP showed an annual rate of 1.5 percent, slightly missing expectations and below the second-quarter’s 3.9 percent. Weekly jobless claims edged higher to 260,000.

“I don’t think there’s a whole lot of market-moving things coming out of the GDP report. I think it’s pretty much as expected,” Self said.

Dow futures continued to trade about 60 points lower after the early morning data releases.

Read MoreI called August bottom, now I see top: Jeff Saut

“I think the second quarter was the exception, in terms of plus-3 percent growth, and the quarters that surround it are going to be a lot weaker,” said Marie Schofield, chief economist and senior portfolio manager at Columbia Threadneedle Investments.

In another disappointing report on the housing sector for the week,pending home sales in September fell 2.3 percent to its second-lowest reading of 2015.

However, Schofield said the weakness in sales was due more to high prices than economic pressure. “Housing I see as a continued plus. I think it’s dependent on low rates and housing prices not increasing too fast,” she said.

Read MoreHere we go again: US budget hangs in the balance

U.S. stocks closed more than 1 percent higher Wednesday after the release of the Fed statement. Financials led S&P 500 advancers, with energy the second-best performer as oil surged 6.3 percent.

“It’s unambiguously positive to get the Fed out of the way,” said Art Hogan, chief market strategist at Wunderlich Securities. “But in the near term … we look at the futures market (lower). We’re not giving back yesterday. We’re cutting it in half.”

“One of the things that’s going to be important to watch is WTI recapturing $45 and holding onto that,” he said.

Energy closed up 0.3 percent, giving up an intraday rally of more than 1 percent, but ended the day as the second-best performer in the S&P 500.

Crude oil futures settled up 12 cents, or 0.26 percent, at $46.06 a barrel, slightly extending Wednesday’s 6.3 percent rally.

Semiconductor stocks declined, with the Market Vectors Semiconductor ETF (SMH) off about 2.5 percent. Weighing on the sector was NXP Semiconductors, which plunged about 19.7 percent after reporting revenue that missed expectations and giving below consensus fourth-quarter revenue guidance, according to StreetAccount.

Baidu, Starbucks, Electronic Arts, LinkedIn, Western Union, Boston Beer, First Solar, Outerwall and SolarCity are among companies due to report after the bell.

Read MoreEarly movers: AET, TWC, MRO, MGM, SHW, MCK, NYCB, AMGN, SNE & more

In Europe, the pan-European Stoxx 600 index ended a touch lower Thursday. In Asia, Japan’s Nikkei finished 0.17 percent higher, while in China the Shanghai Composite closed 0.38 percent higher.

The Dow Jones Industrial Average closed down 23.72 points, or 0.13 percent, at 17,755.80, with Apple leading gainers and Intel the greatest laggard.

The S&P 500 closed down 0.94 points, or 0.04 percent, at 2,089.41, with utilities leading five sectors lower and health care leading advancers.

The Nasdaq composite closed down 21.42 points, or 0.42 percent, at 5,074.27.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 14.5.

About three stocks declined for every two advancers on the New York Stock Exchange, with an exchange volume of 871 million and a composite volume of 3.9 billion in the close.

Gold futures settled down 428.80 at $1,147.30 an ounce.

Thursday

Earnings: Baidu, Starbucks, Electronic Arts, LinkedIn, Boston Beer, First Solar, Live Nation Entertainment

Friday

Earnings: Exxon Mobil, Chevron, Seagate, Brink’s, CBOE Holdings, Rockwell Collins, Mylan Labs, Eldorado Gold, Public Service, Phillips 66, Rubbermaid, Aon, Calpine, Pinnacle West, A-B Inbev, AbbVie, Colgate-Palmolive, CVS Health

8:30 a.m.: Personal Income, Employment Cost Index

9:45 a.m.: Chicago PMI

10 a.m.: Consumer sentiment

10:50 a.m.: San Francisco Fed President John Williams

11:25 a.m.: Kansas City Fed President Esther George.

LINK: http://www.cnbc.com/2015/10/29/us-markets.html