Sarhan CNBC: Stocks mostly higher amid Yellen remarks; oil eyed

“Bottom line on Yellen’s testimony, of the 3 possible options I laid out in my morning note, I believe the Janet Yellen testimony fell into Door Number 2, the non committal one. I say this because she acknowledged all the risks to the downside and positives on the upside to the outlook without leaning in any one direction, thus leaving us with a ‘let’s play it by ear’, middle of the road message,” Peter Boockvar, chief market analyst at The Lindsey Group, said in a note.

“I don’t recall her ever saying that before,” said Peter Cardillo, chief market economist at First Standard Financial.

Yellen answered questions after delivering her remarks, saying “I don’t think it will be necessary to cut rates but like I said monetary policy is not on a preset course.”

“She’s put on the perfect hedge,” said Adam Sarhan, CEO of Sarhan Capital. “She doesn’t want to lose credibility and say she was wrong.”

Leading the three major indexes was the Nasdaq composite, which briefly rose over 2 percent as technology stocks gained ground. Netflixand Alphabet shares gained 5 percent and 1.7 percent, respectively.

“The FANGs had sold off pretty steeply, that could be some short covering … or investors buying indiscriminately,” said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

“You had some hope of an inventory drawdown, but that didn’t hold,” said Art Hogan, chief market strategist at Wunderlich Securities. “You had a build in distillates and that sort of rolled over the market.”

The S&P 500 was up 0.8 percent in up trading, led higher by health care and information technology.

Dow futures traded sharply higher Wednesday, jumping more than 150 points as European equities rallied.

“The pivot point in action today is Deutsche Bank saying they were considering buying back bonds,” Wunderlich’s Hogan said.

Shares of the German bank gained 10.2 percent Wednesday, but remained about 35 percent lower for the year. Meanwhile, the pan-European STOXX 600 index closed 1.88 percent higher.

“[European banks] were never forced to clean up their balance sheets the way ours were, and that’s coming back to bite them,” said Maris Ogg, president at Tower Bridge Advisors.

Investors also kept an eye on U.S. oil prices, which seesawed Wednesday.

“There was talk that Iran was willing to work with the Saudis, and that calmed the market,” First Standard’s Cardillo said.

Prices briefly jumped more than 3.5 percent after the Energy Information Administration said that U.S. oil inventories fell 0.8 million barrels, before paring most of those gains.

The oil market has been maligned by oversupply concerns throughout the year, pushing U.S. crude down about 24 percent this year.

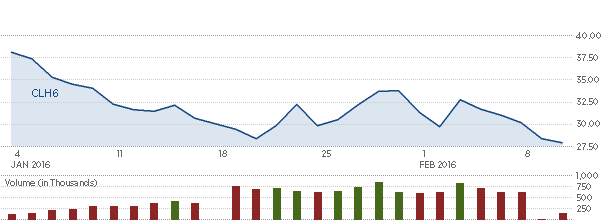

WTI in 2016

“WTI is flirting with with that January low,” Sarhan said. “If that low gets taken out on a closing basis, you could see another leg lower for oil.”

Tthe benchmark 10-year yield traded at 1.72 percent.

“Bonds are not liking [Yellen’s testimony] a little bit,” said Tom Simons, money market economist at Jefferies. “She didn’t say we’re going to backtrack on policy. The focus is on continued normalization and people were looking for signals the other way.”

Read MoreCarl Icahn nurses paper losses on energy bets

The U.S. Treasury Department is scheduled to sell $23 billion in 10-year notes Wednesday.

The dollar rose 0.24 percent against a basket of currencies.

Earnings season continued Wednesday morning, with Time Warner and Humana, among others, reporting before the bell. Cisco Systems, Tesla Motors, Twitter and Whole Foods are scheduled to report after the bell.

The S&P 500 rose 11 points, or 0.6 percent, to trade at 1,863, with health care leading eight sectors higher and utilities lagging.

The Nasdaq gained 63 points, or 1.5 percent, to 4,333.

Gold futures for April delivery fell $5 to trade at $1,193.60 an ounce.

The CBOEVolatility Index (VIX), widely considered the best gauge of fear in the market, traded near 26.

Advancers led decliners 2 to 1 on the New York Stock Exchange, with and exchange volume of 431 million and a composite volume of 1.895 billion as of 12:08 p.m. ET.

— CNBC’s Patti Domm contributed to this report.

Wednesday

Earnings: Time Warner, Cisco Systems, Twitter, Whole Foods, Tesla Motors, Sealed Air, Owens Corning, Nissan, Pioneer Natural Resources, iRobot, Flowers Foods, Rayonier, Zynga

1 p.m.: 10-year note auction

1:30 p.m.: San Francisco Fed John Williams on health and the economy

2 p.m.: Federal budget

Thursday

Earnings: PepsiCo, Kellogg, Nokia, Molson Coors, Time Inc, Groupon, Pandora, Zillow, Teva Pharma, Borg Warner, Advance Auto Parts, CBS, KKR, FireEye, AIG, Activision Blizzard

8:30 a.m.: Initial claims

10 a.m.: Fed Chair Janet Yellen testifies before Senate Banking Committee

1 p.m.: 30-year bond auction

Friday

Earnings: Red Robin Gourmet Burgers, Calpine, Buckeye Partners, Interpublic, Ventas, Brookfield Asset Management

8:30 a.m.: Retail sales; import prices

10 a.m.: Consumer sentiment; business inventories; New York Fed President William Dudley speaks on household debt and credit

*Planner subject to change.