CNBC: Stocks Close Lower As Wall Street Braces For French Election, But Post Weekly Gains

Friday, April 21, 2017

U.S. stocks closed lower in choppy trade Friday as investors looked ahead to the French election. Wall Street also digested falling oil prices and comments from the Trump administration on tax reform.

The Dow Jones industrial average fell about 30 points with IBM contributing the most losses.

The index briefly turned positive in afternoon trade after President Donald Trump told The Associated Press his administration will unveil a “massive tax cut” in a new reform, though the timing of that package was unclear.

The S&P 500 declined 0.3 percent, with telecommunications falling more than 1 percent to lead decliners.

Energy was also among the decliners, falling 0.4 percent as U.S. crude dropped 2.15 percent to settle at $49.62 per barrel.

The Nasdaq composite closed 0.1 percent lower.

“We’ve had a pretty decent week, so people are taking a bit of risk off the table ahead of the French election,” said JJ Kinahan, chief market strategist at TD Ameritrade. “Depending on how it goes, it could be really good or really bad for the euro.”

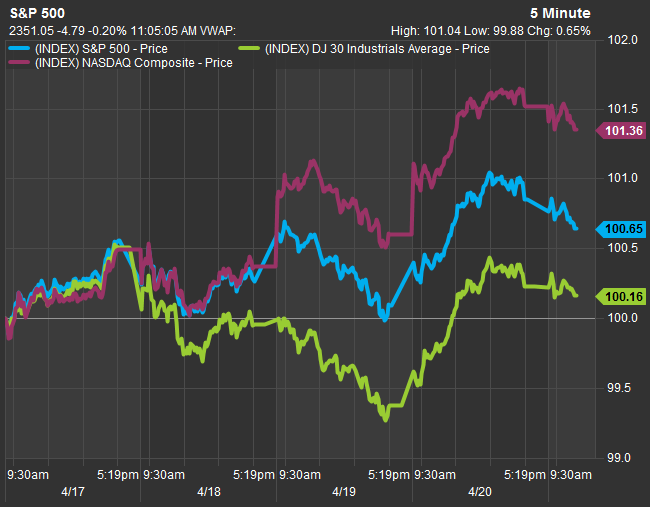

The three major indexes were on track to post slight weekly gains as of 3:08 p.m. ET, with the S&P up around 1 percent for the week. Stocks received a boost from mostly strong earnings reports.

Dow, S&P and Nasdaq This Week

Source: FactSet

Nevertheless, the major indexes are lower for the month, with the S&P and Dow breaking below their respective 50-day moving averages.

“The 50-day moving average is the line of demarcation for this bifurcated market,” said Adam Sarhan, CEO of 50 Park Investments. “The longer the indexes stay below the 50-day moving average, the more negative the outlook gets.”

Equities rallied on Thursday, as corporate earnings and comments from Treasury Secretary Steven Mnuchin on tax reform lifted investor sentiment.

“Investors seem to be optimistic but there are factors dampening that optimism,” said Peter Cardillo, chief market economist at First Standard Financial. “The market is concerned over the French election.”

Uncertainty around the election has grown over the past month after far-left candidate Jean-Luc Melenchon’s surprising surge in the polls. Concerns over a victory from far-right candidate Marine Le Pen rose after a shooting in Paris.

Le Pen has said repeatedly that, if she wins, she’d pull France out of the European Union and the euro zone.

But centrist and pro-European candidate Emmanuel Macron is still the favorite to win the contest, according to French polling firm Ifop. The French presidential election is held over two rounds; the first one will be held Sunday and the second on May 7.

LINK:

http://www.cnbc.com/2017/04/21/us-markets.html